The press and business world both often discuss Blockchain. Although many people have heard of Blockchain, they might not understand it. In its most basic form, Blockchain is a data format that enables the creation of a digital record of transactions and their sharing among a distributed network of computers.

The primary benefit of Blockchain is that it promotes trust between parties transferring data. Because it cannot be taken away, trust is preserved between users. It also allows for safe interactions between users since once information is stored, it cannot be modified without altering all the other records.

Benefits of using Blockchain in Insurance

Efficiency improvements may be made with Blockchain. Fast payments, transparency, and safe data sharing with different parties are all made feasible. Since most insurance procedures are now manual, blockchain technology can help streamline insurance contracts’ paperwork to improve customer satisfaction.

The parties to an insurance contract transaction might feel more confident in one another when the transaction is safe, verifiable, and legitimate. Fortunately, blockchain cryptography allows you to make use of all these advantages.

Due to the current insurance industry’s extreme complexity, visibility holes can be used for fraud. Claims are transferred slowly, manually, and with many moving pieces from insureds to insurers and reinsurers. This allows crooks to file many claims with various insurers for the same loss.

Insurance companies might log permanent transactions on a distributed ledger with fine-grained access controls to safeguard data security. Insurance companies may work together and spot suspicious activity across the ecosystem using claims data stored on a shared ledger.

Why Insurance firms are investing in Blockchain

Major insurers now invest in data from public and private sources to better anticipate and examine fraudulent activity. Public data may be used to spot fraud patterns from past transactions, but it’s frequently inconsistent because it’s hard for various firms to share sensitive information. The restrictions on exchanging personally identifiable information, such as name, address, and date of birth, impede the development of industry-wide fraud prevention.

Insurers would need intense collaboration to implement blockchain technology to minimize fraud, but the long-term benefits might be significant.Typically, groups collectively ineligible for a specific insurance policy may process the decentralized blockchain trust to protect the group. They achieve this by splitting the dispersed risk.

The health and life insurance sector is one of the many stakeholder groups looking at how blockchain technology may benefit this sector. The main outstanding questions are how blockchain technology can reduce costs, minimize risk, and improve user experience.

Impact on Claims processing

Claims processing using Blockchain can assist create a trustworthy, transparent, and customer-focused business model. A client will often initiate the claims procedure by calling a customer care centre or sending an alert using a mobile app. A direct link between the claimant, insurer and third parties can be established in place of this time-consuming procedure, allowing all data to be directly submitted and providing an audit trail.

Suppose underwriting and claims handling can be automated based on set criteria and the availability of trustworthy data sources. In that case, blockchains with smart contracts might be used to provide customers with claim submissions at a cheap handling cost. Payments may be sent to these covered customers when a claim is made. Then it may be conveniently paid using verified databases, clever rules that consider the user’s social media profile, and market developments that can help with any potential fraud forecasts.

Through the lens of data

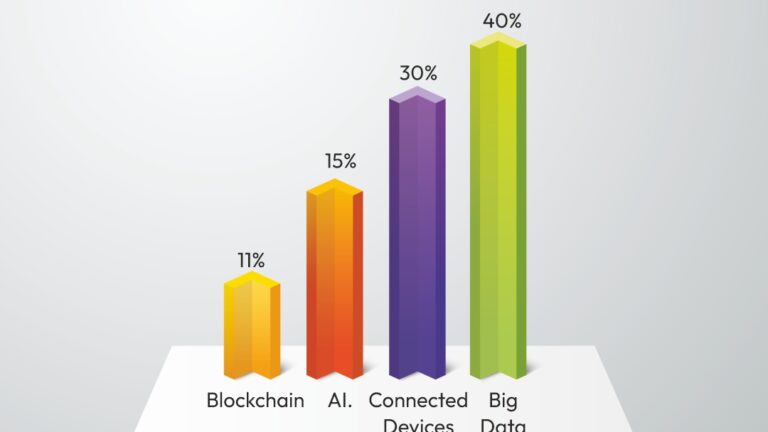

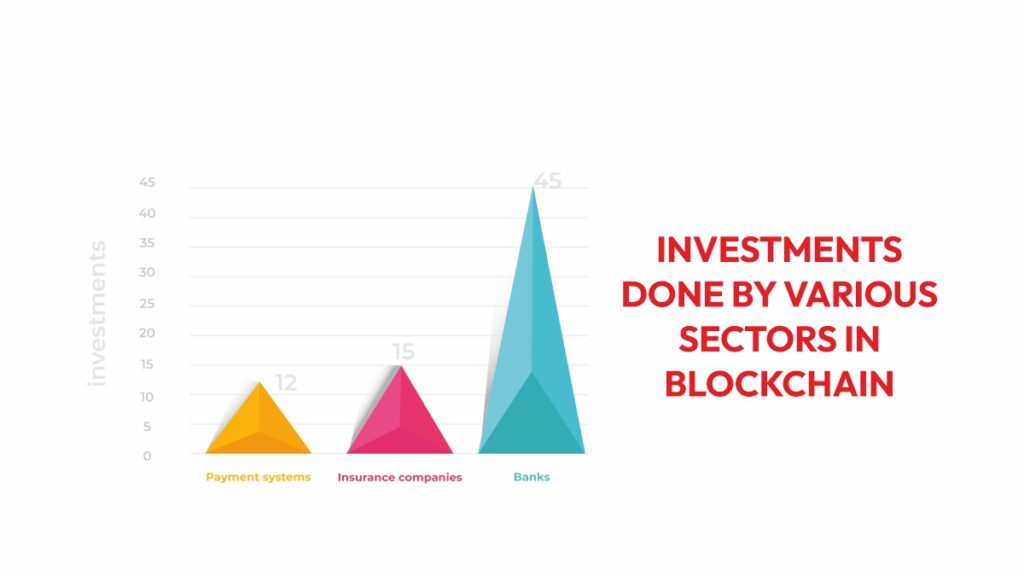

As an insurance professional, we asked what percentage of data were collected by what means, to which respondents said – Big Data (40%), Connected Device(30%), Artificial intelligence (15%), and Blockchain (11%). You will also be curious about what leading financial institutions invest in Blockchain. Then the leading ones are – Banks (45 investments), Insurance companies(15 investments), Payment Systems (12). The market size is also ever-growing, blockading banking and financial services use. In 2019, the market size was 0.5 billion USD; in 2020, it grew to 0.87 billion USD; in 2021, it was 1.5 billion USD; and in 2022, it is projected to rise to 2.5 billion USD.

Customer Retention

Customer retention is one of any insurer’s primary business goals. Insurance companies are constantly seeking fresh approaches to raise client satisfaction and customer-centricity. For instance, several insurers are investing in client loyalty programmes with point-based rewards. The Blockchain can facilitate this, and it can even go a step further by providing a platform that makes it simple to swap points across different loyalty programs—a platform known as a virtual loyalty trading platform.

The first step for insurance businesses should be internal blockchain exploration. Insurers may get started on their own. By organizing hackathons and growing a developer community, people may learn about cutting-edge technology like Blockchain.

When using blockchain technology, insurance firms will probably start by investigating intelligent contracts before moving on to identity authentication. The industry is currently very centralized, so the introduction of new blockchain-powered structures, like peer-to-peer models based on the Blockchain and mutual insurance, could fundamentally alter the status quo. After all, once something is imprinted into a blockchain, it cannot be changed or reversed.

Blockchain helps academics find new codes in the healthcare industry. This is accomplished through promoting secure patient medical information exchanges, managing the medication supply chain, and conducting clinical studies to improve healthcare outcomes.

The insurance business might benefit significantly from Blockchain, but the technology is still in its early stages. The natural potency of this technology is primarily unknown. However, several start-up businesses are pioneering the use of blockchain technology and investigating the advantages of how this technology might enhance corporate operations and consumer happiness in the insurance sector.

The application of Blockchain, which is transparent, solves many problems associated with insurance policies, including getting client consent or approval and working together to invest money in shared infrastructure and resources. A policy’s entire history is accurately and timely recorded. Every transaction’s dates, timings, participants, locations, and values are included. This information is safeguarded from unauthorized or unlawful alterations or tampering since Blockchain distributes consent, making it safer than any prior technology.

Concluding words

It is crucial to realize that any insurance firm that adopts Blockchain must agree to do business under ethical norms, even though Blockchain may significantly benefit the sector in terms of accuracy, efficiency, privacy, and more. For Blockchain to give insurers better tools for teamwork, data sharing, and easing client frustration with insurance processes, standards and procedures must be in line.

Blockchain is a digitalization technology that insurers should consider strategically. Facilitating collaboration between market participants and technology leaders, completing the operational change, and creating an enticing regulatory environment are the major obstacles to its industry-wide deployment. Insurance firms will be able to have scalable blockchain use cases and profit from the advantages of the technology if the groundwork is laid today to address these issues.

Blockchain has the potential to alter the insurance sector for businesses and their clients once these demands are satisfied. Before Blockchain is practicable, it needs to be further improved to fulfil the norms of insurance firms, as the sector has essential privacy and security issues. A clear regulatory framework must be provided by insurance firms as well if blockchain technology is to be used responsibly.